![]()

“Our tax credit is a tried-and-true method, one with a bipartisan track record of success. It’s the paid family leave solution that will do the most good with the smallest price tag.”

Office of U.S. Senator Deb Fischer

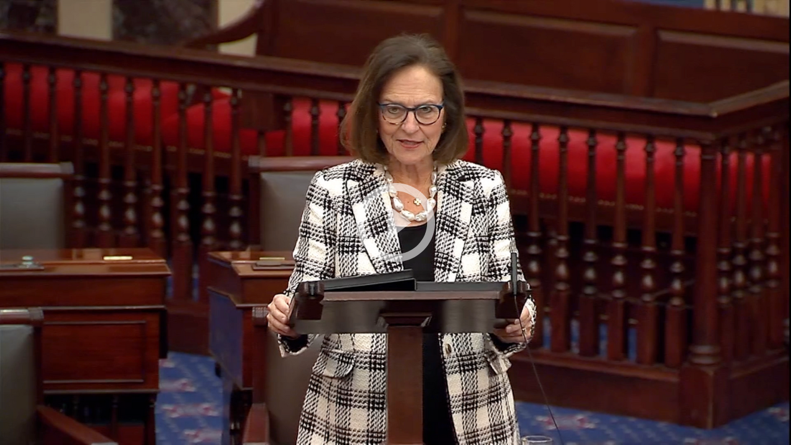

During a speech on the Senate floor, U.S. Senator Deb Fischer (R-Neb.) called on her colleagues to make American families’ lives better by including her Paid Family and Medical Leave Tax Credit Extension and Enhancement Act in the upcoming tax package.

Yesterday, Senator Fischer reintroduced her legislation with Senator King (I-Maine) to make the Paid Family and Medical Leave (PFML) Employer Tax Credit permanent. The Senators first passed their PFML tax credit as part of the 2017 Tax Cuts and Jobs Act, but it is set to expire soon if not extended by the PFML Tax Credit Extension and Enhancement Act.

In her remarks, Senator Fischer emphasized the bipartisan support her legislation has received, as well as its role in fulfilling Republican promises to create a more prosperous and affordable future for American families.

Click the image above to watch a video of Senator Fischer’s remarks.

Click here to download audio

Click here to download video

Following is a transcript of Senator Fischer’s remarks as prepared for delivery:

M. President,

In America, our news cycle is often fraught with controversy and dispute. From watching the news or scrolling social media, it might seem like there are few issues Americans agree on.

It may be true that we disagree on some big issues—important issues. But behind the headlines and social media posts, there are many things Americans still agree on.

One of those is paid family and medical leave.

The Pew Research Center found that the vast majority of Americans support paid parental leave—up to 82 percent. That’s a broad consensus.

85 percent of Americans say people should receive paid leave to deal with their own serious health conditions. 67 percent say they should receive leave to care for a family member with a serious health condition.

We rarely see Americans so united on other issues. But it’s for good reason that Republicans and Democrats come together on paid family leave.

The reality is that Americans shouldn’t have to choose between their paychecks and caring for their families.

That’s why I spearheaded our nation’s first-ever federal family leave policy in 2017 with Senator King.

As part of the 2017 Tax Cuts and Jobs Act, we passed a Paid Family and Medical Leave tax credit that encourages businesses to offer leave to their employees.

Employers are able to receive the tax credit if they voluntarily offer up to 12 weeks of paid leave.

Our credit increases access to paid leave without penalizing small businesses with limited resources, like a government entitlement program or a mandate would.

Almost eight years later, this tax credit is about to expire. And Congress is set to work on another tax package.

Now is the perfect time to pass my bill with Senator King to make our tax credit permanent and improve it.

Yesterday we introduced the PFML Tax Credit Extension and Enhancement Act. Representative Feenstra is leading the introduction of companion legislation in the House.

Our bipartisan, bicameral bill supports additional options for financing paid leave, such as paid family leave insurance. It also allows employers to begin offering paid leave to workers sooner after being hired.

The legislation includes a strategy for educating employers and employees about the option to receive this credit. It requires the Small Business Administration and the IRS to provide targeted outreach and assistance to those who need it, which will raise awareness of the credit and expand the number of Americans who have paid leave.

Passing this bill in our upcoming tax package will deliver on the promises Republicans made to the American people this November.

We promised to make families’ lives better, more prosperous and more affordable. More access to family leave will contribute to that goal.

Our tax credit is a tried-and-true method, one with a bipartisan track record of success. It’s the paid family leave solution that will do the most good with the smallest price tag.

I urge my colleagues to join me in pushing for this legislation’s inclusion in this year’s tax package.

This is how we expand paid family and medical leave for employees across the country. This is how we deliver for the American people. I’m determined to get this done, and I hope my colleagues will join me.

Thank you, M. President, I yield the floor.