![]()

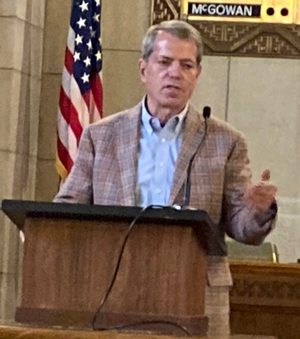

Nebraska Gov. Jim Pillen expressed disappointment Monday that despite an additional $324 million dollars in state aid to K-12 schools, school property taxes still increased by $85 million – which he called “unacceptable.”

92 of the state’s 244 school districts lowered or didn’t increase property tax revenue while 188 voted to override the 3% revenue cap – increasing taxes for most. Some districts both overrode the cap and still had no increase in taxes.

Pillen, who called the news conference to praise the districts that did cut taxes, said the intent of last year’s package for overriding the 3% soft cap to be the exception to the rule – adding that “We have to stop spending money.”

Joining Pillen at the news conference were the superintendents of the Elwood and Norris school districts, which were able to reduce property taxes due to the influx of new state money.

. Both superintendents, though, said they were unable to produce a “dollar-for-dollar” decrease in property taxes as Pillen hoped because of the need to increase staff salaries and deal with inflated costs of fuel and other materials.

Norris Superintendent Brian Maschmann said his district received an additional $2.1 million dollars in aid but cut property taxes only about $626,000 – dropping the tax rate from $1.15 to 93-cents per hundred dollars of assessed value.

When asked what he’d tell the 188 school districts that overrode the 3% cap, Maschmann said every school district is different financially with different needs and while he thinks Norris can live within the cap, he can’t speak for other districts.

Pillen was asked if he could push for a tougher cap in next year’s legislative session, the governor said it wasn’t his intent but later he also said he planned to work with senators during the session to further reduce property taxes.